The Trade War’s Expanding Battlefield: How American Businesses Are Paying the Price

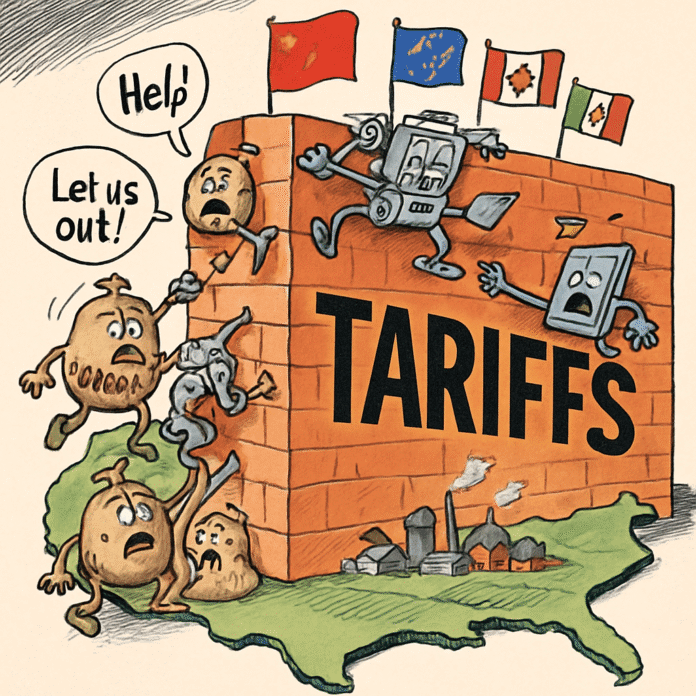

The tariffs that began as targeted economic weapons have evolved into a widespread trade conflict affecting virtually every sector of the American export economy. Recent supply chain data reveals that what started as a focused policy has expanded dramatically, reshaping global trade relationships and challenging U.S. businesses in unexpected ways.

The Expanding Scope of Trump’s Trade War

When the Trump administration first implemented tariffs in 2018, they targeted specific industries like steel and aluminum under Section 232 of the Trade Expansion Act, citing national security concerns. What followed was a cascade of additional tariffs under Section 301, primarily aimed at Chinese goods, justified by allegations of intellectual property theft and unfair trade practices.

What many Americans don’t realize is how dramatically these tariffs have expanded. Recent supply chain analysis shows that retaliatory measures from China, the European Union, Canada, and Mexico have effectively created barriers for nearly all U.S. exports. The weighted average tariff rate has reached levels not seen since the mid-20th century.

“The tariffs were supposed to be a surgical tool to address specific trade imbalances,” notes trade economist Sarah Chen. “Instead, they’ve become a blunt instrument affecting the entire U.S. export economy.”

The Real Cost to American Businesses

The economic impact extends deep into American business operations. Companies reliant on imported materials face increased production costs, while exporters struggle with retaliatory tariffs that make their products less competitive abroad.

Studies indicate these tariffs have:

- Raised costs for American manufacturers by 10-15% on average

- Increased consumer prices by approximately $1,200 annually per household

- Contributed to a reduction in U.S. GDP by approximately 0.8% short-term

- Particularly damaged agricultural exports, with soybean exports to China falling by over 70% at one point

For small business owner Michael Reeves, who manufactures specialized equipment in Ohio, the impact has been severe: “We’ve seen our material costs increase by 18% while simultaneously losing market share in Europe due to retaliatory tariffs. It’s a double hit we weren’t prepared for.”

Global Relationships Reshaped

The widespread deployment of tariffs has significantly altered U.S. relationships with major trading partners. China’s counter-tariffs on agricultural products and manufactured goods had immediate repercussions, while European measures targeted signature American products like motorcycles, bourbon, and orange juice.

These tensions prompted significant renegotiations of existing trade agreements, including the USMCA replacing NAFTA and the Phase One trade deal with China. However, many structural issues remain unresolved, creating persistent uncertainty in global markets.

The Path Forward: Balancing Protection and Growth

As policymakers evaluate the tariff strategy, several approaches could mitigate adverse effects:

- Re-engaging in multilateral trade agreements to improve market access

- Implementing targeted tariff reductions on critical materials

- Increasing domestic investment in technology and workforce development

- Enhancing diplomatic efforts to resolve ongoing disputes

“The challenge now is finding the balance between protecting sensitive industries and allowing our export economy to thrive,” explains former trade negotiator James Wilson. “We need a more surgical approach that addresses legitimate concerns without creating collateral damage.”

What This Means for American Consumers and Workers

The ripple effects of these expanded tariffs ultimately reach American households through higher prices and economic uncertainty. Industries dependent on exports—from agriculture to advanced manufacturing—have been particularly hard hit, with many companies forced to reconsider their global supply chains.

For workers in export-dependent industries, the consequences have been mixed. While some manufacturing jobs have been protected, others in export sectors have faced pressure as global demand for American goods decreases due to retaliatory tariffs.

Looking Ahead: The Future of U.S. Trade Policy

The legacy of these tariffs presents both challenges and opportunities. While tariff revenues may bolster federal budgets—estimated to reach $5.2 trillion over the next decade—the associated economic drag may result in reduced GDP growth and lower household incomes.

Finding a path that balances legitimate protection of American industries with the need for global competitiveness remains the central challenge for current and future administrations. The data suggests that a more nuanced, collaborative approach may better serve American economic interests in an increasingly interconnected global economy.

As we navigate these complex trade relationships, one thing is clear: the impact of tariff policies extends far beyond their intended targets, reshaping not just specific industries but the entire landscape of American exports.