The Widening Chasm: A Data-Driven Look at the Black-White Economic Gap

By David & Dawn LaGuerre –

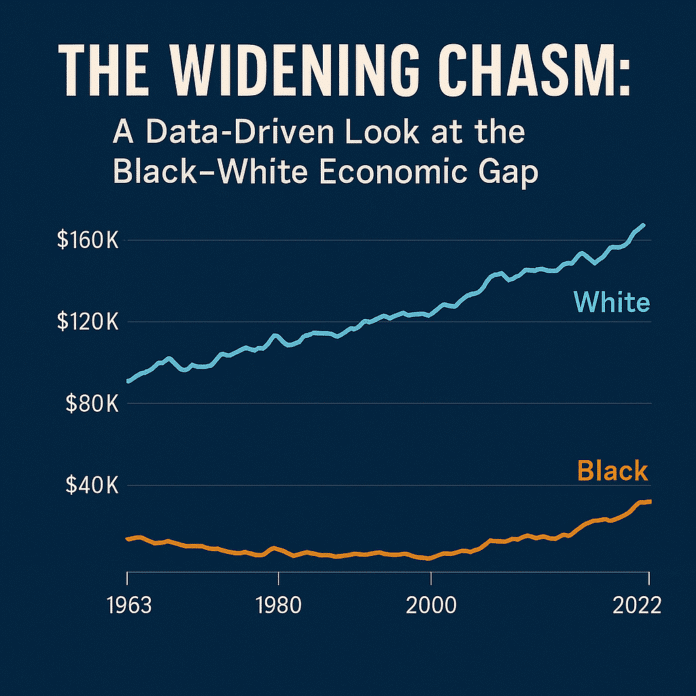

Few issues capture the persistent inequity in our society as starkly as the widening economic gap between Black and white Americans. Recent data paint a sobering picture: between 2019 and 2022, the mean net worth gap surged from $841,900 to $1.15 million. For many Black families, the promise of prosperity remains elusive, while for white households, generational wealth and systemic advantages continue to compound over time. This article delves into the data, explores the underlying factors, and considers what changes might be necessary to create a fairer economic landscape.

The Growing Divide: National and Local Realities

A look at the data reveals a multidimensional story of inequality. At the national level, the disparities are both glaring and persistent. The Economic Policy Institute reports that the typical white family possesses roughly eight times the wealth of the typical Black family. For instance, while the average white household holds over $1.3 million in net worth, Black households average just over $200,000. Localized studies underscore this uneven picture; a 2024 Chicago Urban League report shows that the median net worth for Black households in the Chicago area stands at zero dollars compared to $210,000 among white households.

These statistics are not just abstract numbers. They represent generational disadvantages. The data hint at why, even with education and diligent work, Black families often find themselves unable to build the generational wealth that white families accumulate over time.

Economic Indicators Behind the Gap

Wealth Beyond Income

At first glance, one might assume that closing income gaps would naturally narrow the overall wealth disparity. However, the evidence challenges that narrative. The recent Duke University study emphatically argues that the traditional “human capital” theory, which suggests that education and higher earnings will eventually close the wealth gap, does not hold true in today’s economic environment. In fact, Black households headed by a college graduate tend to have less wealth on average than white households headed by someone with only a high school diploma or GED.

The reason lies in the way wealth is built over generations. White families often transfer significant resources and assets through inheritances while prospering from investments in corporate stocks—assets that have appreciated far more dramatically than real estate, which constitutes a larger share of Black families’ portfolios. This intergenerational transmission of wealth creates a cycle where the rich get richer while barriers to asset accumulation remain high for Black families.

Income, Employment, and Persistent Poverty

Beyond household wealth, the labor market tells a story of deep-seated inequities. Black workers have been consistently earning around 20% less than their white counterparts. Historical wage gaps started at roughly 16.4% in 1979 and have since grown wider. This wage penalty is compounded by significant differences in employment opportunities. While white workers enjoy considerably lower unemployment rates, Black workers have long experienced persistently higher unemployment. As of May 2025, the unemployment rate for Black workers stood at 6.0% compared to just 3.8% for white workers.

These disparities extend to the lives of children. According to recent statistics, one in three Black children lives in poverty—a rate more than three times higher than that of white children. Similarly, food insecurity affects 22% of Black households, compared to a rate less than 11% for white households. These economic stresses manifest not only in statistics but in everyday lives marked by uncertainty over basic needs.

Homeownership and Asset Accumulation

Homeownership has long been considered a key avenue for building wealth. Yet, the gap in homeownership between Black and white Americans remains wide. In 2021, 46% of Black households owned their homes compared to 71% of white households. While owning a home is a critical step toward securing financial stability, structural barriers—rooted in discriminatory lending practices and historical policies such as redlining—have left many Black families with limited access to affordable and appreciating property.

Furthermore, when Black families do manage to invest in real estate, their dwellings rarely appreciate at the same rate as suburban properties predominantly owned by white families. These outcomes, combined with challenges in accessing credit and favorable mortgage terms, work to reinforce the chasm between the races.

Structural and Historical Drivers

Beyond Human Capital

The limitation of the “human capital” framework becomes evident when we consider the broader context. Although many center-left observers have advocated for improved education and job training as keys to economic mobility, the data show that even highly educated Black individuals struggle to match the wealth accumulation of white families with less formal education. The answer, therefore, lies not in personal shortcomings but in a system that systematically privileges wealth accumulation through inheritance and high-yield investments.

The Intergenerational Transmission Chain

At the heart of the disparity is the intergenerational transmission of wealth. For decades, white families have benefited from a system that allows wealth to be passed down with few impediments. Whether it’s through favorable tax policies that reduce the cost of transferring assets or decades of asset appreciation concentrated in the corporate stock market, these structural advantages create a self-reinforcing mechanism of prosperity. Conversely, Black families, who were systematically denied opportunities to build wealth due to discriminatory policies, continue to face an uphill battle.

Discriminatory Practices and Policy Neglect

Historical policies, such as redlining, provide context to the contemporary reality of the wealth gap. For decades, Black neighborhoods were designated as high-risk for mortgage lending, stifling opportunities for homeownership and community investment. Although redlining has been illegal for years, the legacy of these practices persists in lower neighborhood values, diminished access to capital, and reduced opportunities for economic mobility. When modern financial instruments further amplify the appreciation of assets held primarily by white families, the gap only widens.

Policy Implications and the Road Forward

The data leave little room for complacency. Addressing the Black-white economic gap requires bold, systemic changes rather than incremental adjustments to education or wage policies.

Reparations and Wealth-Building Initiatives

One argument that has gained traction is the need for reparations. Beyond a symbolic gesture, reparations could provide the capital injection needed to offset centuries of disparity. By offering financial resources directly to Black families, reparations could initiate a cycle of wealth-building that has long been denied to them. Progressive tax reforms, combined with targeted investments in Black business development, education, and housing, are equally critical.

Reforming Tax and Inheritance Policies

Current tax structures often favor inherited wealth and capital gains, which disproportionately benefit white households. A reformed tax system that balances the scales could help democratize the accumulation of assets. Policies geared toward reducing the tax benefits of large inheritance transfers or reinvesting those funds into community development are potential avenues for reducing the gap.

Enhancing Access to Capital

Ensuring equitable access to capital is another vital component of any solution. Reforms to mortgage lending practices, increased oversight of discriminatory lending, and robust community reinvestment programs can help level the playing field. These measures not only facilitate homeownership but also promote broader economic participation within Black communities.

A Call to Center-Left Values

For readers who value fairness, democracy, and the rule of law, the evidence provides a compelling impetus for change. By recognizing that the problem is not simply one of individual effort but of structural inequity, policy-makers and communities alike can work toward a society where opportunity is truly universal. As we collectively navigate the challenges of economic disparity, it is worth remembering that a thriving democracy depends on an economy that works for everyone.

Reflecting on the Way Forward

The data on the Black-white economic gap reveals a troubling trend: despite visible progress in some areas, the systemic inequities built into our financial and social systems remain deeply entrenched. When Black unemployment is almost double that of white unemployment and when the median net worth of Chicago-area Black households stands at zero, we are urged to look beyond simplistic narratives.

The challenge calls for a rethinking of conventional wisdom. Instead of relying solely on education and wage increases, it is necessary to address the historical and structural factors that perpetuate the wealth gap. As we move forward, it is incumbent on policy-makers, community leaders, and all stakeholders to implement reforms that dismantle these barriers.

This is not just an economic issue—it is a moral imperative. To build a just society, we must face these stark disparities head-on and work collectively toward systemic change. The struggle for economic justice is deeply intertwined with the broader fight for civil rights and human dignity.

Every effort to narrow the gap is a step toward a more equitable society where future generations can inherit not just money, but a more hopeful promise of equality and opportunity. We invite readers to reflect on these findings, share their views, and join the conversation. Your voice matters in shaping the path forward in our collective mission for economic justice.