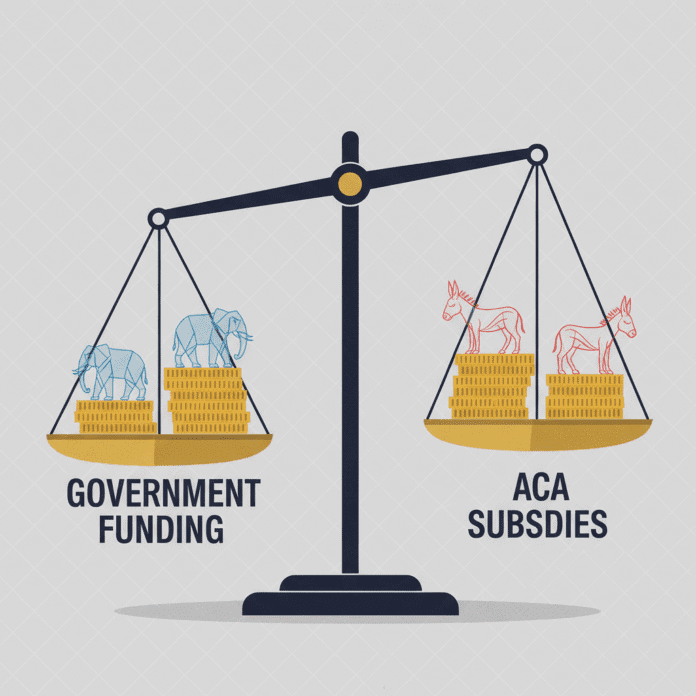

Republicans and DemRepublicans and Democrats float a short-term fix to protect Affordable Care Act subsidies as the September 30 funding deadline nears.

The unlikely alliance is real: lawmakers in both parties are signaling support to extend Obamacare tax credits before they expire—and they may try to attach that fix to spending legislation due before September 30 to avert a shutdown. Here’s what that means in plain terms. If Congress extends the Obamacare tax credits (the Affordable Care Act’s enhanced premium subsidies), millions of people would avoid sharp premium hikes next year; if they don’t, costs jump. With a funding deadline days away, both sides are weighing a deal that keeps the government open and keeps health insurance more affordable Reuters.

Why this matters now

The clock is ticking toward the September 30 deadline to fund the government. In a rare twist, Republicans and Democrats are coalescing around a practical add-on: extending enhanced Affordable Care Act premium tax credits to stabilize costs for families in 2026. Multiple outlets report bipartisan interest in tying an ACA subsidy extension to a continuing resolution or broader funding package, an approach that could both avert a shutdown and prevent insurance sticker shock for marketplace enrollees (Reuters; POLITICO).

“Some Republicans are open to extending those credits before they expire at the end of the year,” the Associated Press reported, as Democratic leaders press to include health provisions in any funding deal (ABC News/AP).

Meanwhile, health policy trackers note the price tag for a one‑year extension is about $24 billion, a level that has not scared off moderates in either party given the consumer impact and electoral stakes (Holland & Knight).

What are Obamacare premium tax credits?

ACA premium tax credits reduce the monthly cost of marketplace health plans by capping what families pay as a share of income; recent enhancements expanded eligibility and generosity to cover more middle‑income households.

The emerging deal: What’s on the table

H2: A short-term extension to prevent premium spikes

- Lawmakers are discussing a one-year extension of the ACA’s enhanced premium tax credits so they don’t lapse at year’s end, with the extension likely riding on a short-term government funding bill (Holland & Knight).

- A bipartisan House bill led by Reps. Jen Kiggans (R‑VA) and Tom Suozzi (D‑NY) would extend the subsidies through 2026; additional Republicans, including Brian Fitzpatrick (R‑PA), have signaled support (JD Supra).

“We need to give families more time to plan,” Rep. Kiggans said as she highlighted reliance on the credits among her constituents (JD Supra).

H2: Why Republicans are listening—and Democrats are pushing

H3: GOP calculus

- Republicans face pressure to avoid premium spikes for middle‑income families in swing districts and to keep a shutdown off the front page (POLITICO).

- Policy aides acknowledge that a clean, short-term extension may be easier to defend than a lapse that leads to higher costs in January (Thomson Reuters Checkpoint).

H3: Democratic priorities

- Democrats want an ironclad commitment on health care provisions in any funding bill and are willing to draw a hard line to secure the ACA subsidy extension (ABC News/AP).

- The party sees the credits as central to affordability for millions and a pillar of the ACA’s record enrollment, which they do not want to jeopardize (The New York Times).

What families stand to gain—or lose

H2: If credits are extended

- Marketplace customers avoid a “January premium cliff,” preserving lower monthly payments.

- States and insurers get predictability, reducing volatility in 2026 plan offerings.

H2: If credits lapse

- Many middle‑income consumers would lose eligibility, especially those just over 400% of the federal poverty level, and face higher premiums (Thomson Reuters Checkpoint).

- Enrollment could dip as price sensitivity kicks in, undermining coverage gains (The New York Times).

The politics of a September deal

H2: Can a shutdown be avoided with health policy attached?

- Senate and House leaders are assessing whether a continuing resolution that includes the ACA fix can clear both chambers quickly enough to beat the deadline (Holland & Knight).

- Some Republicans back the subsidy extension in concept but want offsetting savings or guardrails, while Democrats argue the consumer impact justifies swift action (ABC News/AP; Reuters).

H3: Cost vs. coverage—fair counterarguments

- Fiscal hawks question adding $24 billion for one year without a clear pay-for, warning of deficit creep (Holland & Knight).

- Others argue temporary extensions create policy whiplash for insurers and families; a multi‑year deal—or permanent fix—could reduce annual brinkmanship.

- Supporters counter that a lapse would be costlier for consumers, and that maintaining coverage prevents downstream costs from delayed care.

What to watch next

H2: Key signals in the days ahead

- Text of any stopgap funding bill: Does it include the ACA extension as written in the Kiggans–Suozzi framework? (JD Supra)

- Leadership statements: Are Senate and House leaders framing the subsidy extension as nonnegotiable, or as a trade for other concessions? (ABC News/AP)

- Whip counts: Do enough Republicans sign on to avoid a shutdown while securing relief for ACA enrollees? (POLITICO; Reuters)

H3: Bottom line

If the bipartisan momentum holds, Congress can both keep the lights on and keep premiums in check. If it falters, families could face higher costs and Washington could stumble into a shutdown—an outcome neither party wants to own.

FAQs and quick definitions

H2: Fast facts for readers and editors

- ACA premium tax credits: Dollar-for-dollar reductions in monthly premiums based on income.

- “Enhanced” credits: Temporary expansions that made the subsidies larger and available to more middle‑income households.

- Why now? The enhanced credits expire at year’s end; funding for the government expires Sept. 30, creating a legislative vehicle.

A pragmatic path is in sight

This is what governing looks like when the stakes are real. Extending Obamacare tax credits is not about scoring points; it’s about keeping coverage affordable for families who plan their budgets to the dollar. Leaders in both parties see the logic. As one GOP moderate put it, giving families “more time to plan” is common sense policy that can also calm a jittery insurance market (JD Supra).

Your voice matters. Contact your representatives today—urge them to keep the government open and extend the ACA premium tax credits. A short-term fix now can prevent a long-term problem later.