Governor Hochul Warns Families About Rising Fraud as Inflation Drives Early Shopping

Back-to-school scams are targeting New York families earlier than ever this year, with fraudsters exploiting inflation fears and looming tariffs to steal money and personal information. As Governor Kathy Hochul’s office warns, desperate shoppers hunting for deals are walking straight into sophisticated traps that could cost them hundreds or thousands of dollars. But you don’t have to become a victim.

We’re seeing scammers get smarter and more aggressive. They know families are feeling the financial squeeze, and they’re using that pressure against us. The good news? Armed with the right knowledge, we can protect ourselves and our children from these predators.

Why Scammers Are Targeting Families Now

This back-to-school season looks different from previous years. Rising costs have pushed families to start shopping earlier, creating more opportunities for fraud. Governor Hochul put it bluntly: “We want families to enjoy the remainder of summer, not spend it dealing with the fallout of scams while shopping for the school year ahead.”

The numbers tell a sobering story. Americans lost $47 billion to identity fraud and scams in 2024, up from $43 billion in 2023. That’s real money coming out of real families’ pockets. The Federal Trade Commission recorded $12.5 billion in consumer losses to fraud, with 6.5 million complaints filed.

The Perfect Storm for Scammers

Three factors are creating ideal conditions for back-to-school fraud:

- Inflation pressure making families desperate for deals

- Early shopping due to tariff concerns giving scammers more time to operate

- Sophisticated fake websites that look identical to legitimate retailers

We’re not just dealing with amateur hour anymore. These scammers have upped their game.

Most Common Back-to-School Scams Hitting New York

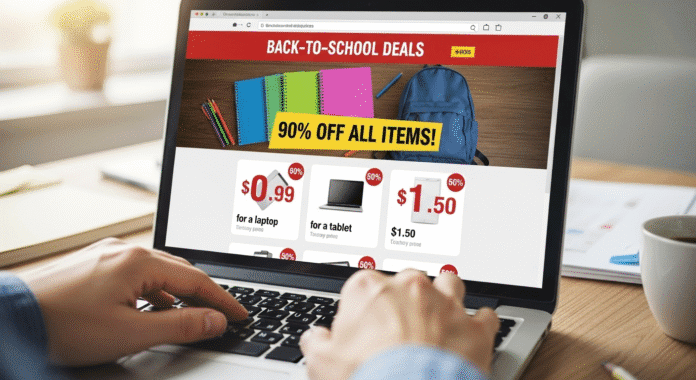

Fake Online Shopping Deals

Scammers create convincing fake websites offering school supplies, electronics, or textbooks at unbelievable prices. You pay, but your items never arrive. Sometimes you receive cheap knockoffs that break immediately.

The red flags are obvious once you know what to look for. Prices that seem too good to be true usually are. Missing contact information, poor grammar, and requests for unusual payment methods should send you running.

Phishing Attacks Targeting Students and Parents

These scams arrive as official-looking emails or texts claiming you missed a delivery of school supplies. Click the link, and you either download malware or get redirected to a fake site that steals your login information.

The College Board doesn’t make unsolicited calls asking for social security numbers or credit card details. Neither do legitimate scholarship organizations. Remember this when those “too good to be true” offers start flooding your inbox.

Scholarship and Grant Fraud

With college costs skyrocketing, families are particularly vulnerable to fake scholarship offers. Scammers know this and create elaborate schemes complete with official-looking documents and websites.

Here’s what you need to know: legitimate scholarships never require upfront fees. If someone asks for money to “process” your application or “guarantee” your award, walk away immediately.

Textbook Scams on Social Media

Students sharing textbook lists on social media become easy targets. Scammers reach out with offers for discounted books, requesting payment through cash transfer apps or gift cards. Once you pay, they disappear.

Your Shield Against Scammers: Proven Protection Strategies

Verify Before You Buy

Major retailers allow third-party sellers on their platforms, and those sellers may have different policies than the main retailer. Read the fine print carefully. Check seller ratings and reviews before making any purchase.

New York law requires retailers to post their refund policies clearly. If you don’t see one, you generally have 30 days from purchase to get a full refund with your receipt. As of August 7th, this policy also applies to online retailers selling in New York.

Use Smart Payment Methods

Credit cards offer fraud protection that debit cards often don’t. Many come with zero-fraud liability, meaning you won’t pay for unauthorized charges. Avoid sites that only accept gift cards, wire transfers, or cryptocurrency. These are massive red flags.

Protect Personal Information Like Your Life Depends on It

Because in many ways, it does. Social security numbers, addresses, and school information should be guarded carefully. Ask after-school programs and sports clubs how they secure your child’s data. Are digital records encrypted? Are physical records locked up?

When organizations ask for your child’s Social Security number, ask why they need it. Often, it’s just a formality and they’ll accept alternative identification.

Educate Your Children About Online Safety

Kids need to understand these threats too. Teach them to create strong passwords and set social media accounts to private. They should reject friend requests from strangers and never click attachments from unknown senders.

What New York Officials Want You to Know

Governor Hochul’s warning carries special weight this year. “As New York’s first mom governor, I know how important it is to get items at lower prices,” she said. “That’s why I’ve been working hard to put more money back in your pockets, but looming tariffs from the White House are going to take it right back out.”

The state’s Division of Consumer Protection offers mediation services for disputes with businesses. You can file complaints online or call the Consumer Assistance Helpline at 1-800-697-1220.

New Consumer Protections Taking Effect

Recent legislation strengthens your rights as a shopper. Stores must now disclose if they electronically track your return history. Credit card companies must give you 90 days to redeem rewards points when accounts close or programs change.

Red Flags That Should Make You Run

Watch out for these warning signs:

- Prices dramatically below market value

- Requests for payment via gift cards or wire transfers

- Poor website design with spelling errors

- No customer service contact information

- Pressure to “act now” or “limited time only” tactics

- Unsolicited emails about scholarships or grants

- Requests for Social Security numbers from unknown organizations

Trust your instincts. If something feels wrong, it probably is.

Taking Action When Scams Strike

If you suspect fraud, act quickly. Contact your credit card company or bank immediately to dispute charges. File reports with the FTC and New York’s Division of Consumer Protection. The faster you move, the better your chances of recovering your money.

Document everything. Save emails, take screenshots, and keep receipts. This evidence becomes crucial if you need to file insurance claims or work with law enforcement.

Your Family’s Financial Future Depends on Smart Choices Today

We can’t let scammers steal our children’s educational opportunities. By staying informed, asking questions, and using common sense, we protect not just our money but our family’s future.

The back-to-school season should be exciting, not stressful. When we arm ourselves with knowledge and remain vigilant, we can focus on what really matters: giving our kids the tools they need to succeed.

Remember, legitimate businesses want to earn your trust, not rush you into hasty decisions. Take your time, do your research, and shop smart. Your future self will thank you.

What scams have you encountered while back-to-school shopping? Share your experiences in the comments below to help other families stay safe. And if you found this information helpful, please share it with other parents in your community.