What the new tax law really means for your Social Security, taxes, and future.

The promise of no tax on Social Security benefits sounds like a dream for millions of seniors. Trump’s “Big Beautiful Bill” promises a tax deduction designed to relieve the financial burdens on many retirees. However, while the bill delivers measurable tax relief for some, it also carries hidden costs, temporary benefits that expire, and long-term risks that may undermine the very programs many seniors depend on.

What the “Big Beautiful Bill” Does for Seniors

Trump’s “Big Beautiful Bill” introduces a Social Security tax deduction for seniors aged 65 and older. Under the new law, each eligible individual may claim up to$6,000 in deductions$12,000 for married couples. This deduction reduces the taxable portion of Social Security benefits and is estimated to boost the after-tax income of roughly 33.9 million seniors by an average of$670. Nearly 90% of Social Security beneficiaries could see their federal taxes on benefits reduced or eliminated if their incomes fall below specified thresholds.

However, the benefit is not universal. Individuals earning more than$75,000 (or$150,000 for couples) gradually lose out on this deduction. In addition, the poorest seniors, who already pay no taxes due to their low income, do not receive any benefit at all. Younger beneficiaries of Social Security, such as those on disability or survivor benefits, are also left out. With its sunset clause set for 2028 unless Congress intervenes, the measure provides only temporary relief.

Evaluating the Positives and Negatives

The Positives

One of the key advantages of the bill is the immediate tax relief it offers to middle-income seniors. Many retirees who have felt the pinch of rising living and healthcare expenses now have extra money in their pockets—helping them cover everyday costs. The deduction is applied regardless of whether a senior takes the standard deduction or itemizes, making tax planning more flexible. As AARP has pointed out, the measure is a boon for those who pay taxes on Social Security benefits and need every dollar to make ends meet.

For middle-income retirees, this tax cut translates to extra disposable income that can ease the pressure of fixed budgets. The boost may not transform lives overnight, but it provides timely support as seniors grapple with the challenges of an evolving economic landscape.

The Negatives

Despite its promises, the bill has several drawbacks. First, it excludes both the poorest seniors—who pay no income tax on their benefits—and high-income retirees who earn beyond the phase-out thresholds. This means that while many middle-income seniors experience relief, the policy fails to reach those who may need long-term stability the most. Critics argue that benefits given on a temporary basis may ultimately lead to a fiscal cliff, where beneficiaries face sudden tax increases once the provisions expire.

The deduction also affects Social Security’s overall health. Revenue generated by taxing Social Security benefits plays a vital role in funding the program. By reducing that revenue, the bill accelerates the projected insolvency of the Social Security trust fund. In simple terms, while today’s retirees enjoy a tax break, tomorrow’s benefits could be reduced if the program’s financial footing weakens further.

A Social Security advocate summarized the dilemma:

“Temporary tax relief is helpful, but not if it undermines the programs seniors rely on. We need solutions that are both fair and sustainable.”

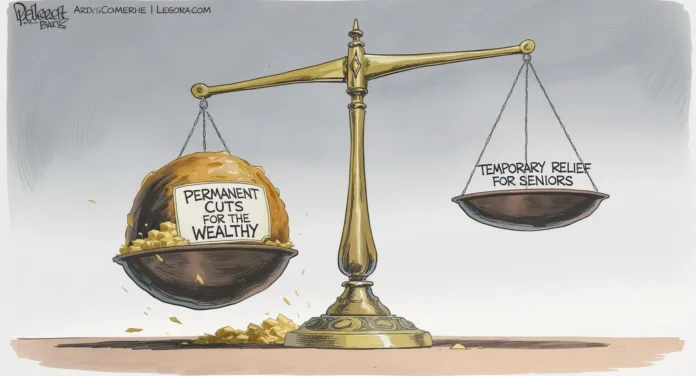

Tax Cuts: Temporary Relief for Many, Permanent Benefits for the Wealthy

How the Bill Differentiates Tax Relief

The “Big Beautiful Bill” does more than adjust Social Security taxes. It extends the permanent tax cuts from the 2017 Tax Cuts and Jobs Act, a change that predominantly favors high-income earners. Households making over$217,000 a year receive the lion’s share of the benefits, while the wealthiest see their after-tax income increase substantially. This permanence means that while middle- and low-income families receive temporary measures—like the Social Security tax deduction, increased child tax credits, and specific breaks for tip income and overtime—the benefits for the rich will continue indefinitely.

This clear structure creates a two-tiered system. Middle-income tax relief provisions are scheduled to expire by 2028, creating uncertainty for those who depend on them. Conversely, the high-income cuts, including expanded deductions for estate and gift taxes, have no sunset date, effectively locking in gains for the wealthy.

The Expiration Trap: Short-Term Gains Versus Long-Term Costs

Initial tax cuts can feel like a windfall, offering immediate financial relief and boosting consumer confidence. For instance, many families might see extra take-home pay that helps with monthly bills or home improvements. Yet, these gains are often short-lived. When temporary tax incentives expire, families can suddenly find their tax burdens increasing, erasing the benefits once enjoyed.

Historical examples, including previous tax reforms, illustrate that while tax cuts might temporarily stimulate economic activity, they rarely generate enough revenue to cover their costs. Analysts have raised concerns that these front-loaded benefits, when combined with reduced funding for critical programs like Medicare and SNAP, could lead to steep fiscal consequences and deeper cuts down the road.

Long-Term Implications and Economic Trade-Offs

The Cost of Metadata: Ballooning Debt and Underfunded Programs

Economists and fiscal experts warn that the overall package may push federal deficit spending to new highs. The Tax Policy Center projects that the “Big Beautiful Bill” will add between$3.3 and$3.9 trillion to the federal deficit over the next decade. Much of this increased borrowing is expected to come at a time when revenue from Social Security taxes is crucial to sustaining a program that many rely on for retirement security.

Cuts made in other areas, such as Medicare, further compound the challenge. As funding for essential services diminishes, seniors and low-income families may face tougher choices between healthcare and other necessities. The reliance on deficit spending and temporary tax measures may yield short-term popularity but at a long-term cost that risks weakening the economic safety net.

The Warning from Experts

The economic reality is that while tax cuts can boost short-term growth, they tend to have limited long-term benefits unless paired with substantial reforms and responsible fiscal management. The Penn Wharton Budget Model and independent analysts have consistently noted that the optimistic forecasts used by proponents of the bill are likely to fall short of reality. When benefits expire and deficits rise, the proverbial bill inevitably arrives, many years down the road, demanding difficult choices from policymakers and taxpayers alike.

Balancing Today’s Relief with Tomorrow’s Security

Trump’s “Big Beautiful Bill” offers a mixed picture. It delivers genuine, though temporary, relief for many middle-income seniors by lowering the taxes on Social Security benefits. At the same time, it creates a long-term imbalance by granting permanent tax cuts to higher-income households and reducing the revenue needed to fund Social Security. In the short term, some families may experience a modest boost in disposable income. Over the long run, however, the bill’s temporary measures and risky fiscal assumptions could lead to reduced benefits and a weakened safety net for those who depend on it the most.

Seniors and concerned citizens should monitor these developments closely. As debates continue over the best approach to balancing immediate relief with long-term sustainability, your voice matters. Stay informed, contact your representatives, and insist on policies that protect the future while addressing today’s needs.