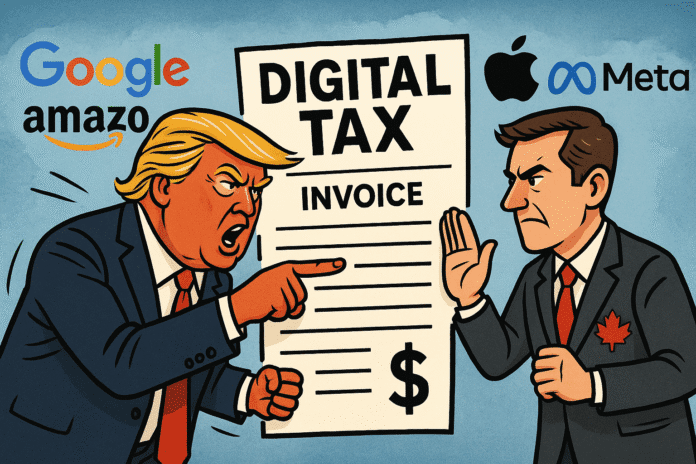

A new digital services tax sparks a major rift between two of North America’s closest trade partners, putting billions in trade and tech at risk.

On June 27, 2025, former President Donald Trump abruptly ended all trade discussions with Canada over a new digital services tax (DST) that targets large U.S. technology firms. In his statement on Truth Social, Trump labeled the tax as a “direct and blatant attack on our country” and warned that Canada would soon face tariffs on its goods. This decision touches on issues of fairness in digital taxation, cross-border economic stability, and the long-standing economic ties between the two nations. As one of the world’s largest trading relationships, any disruption between the U.S. and Canada carries major implications for businesses, consumers, and policymakers on both sides of the border.

Understanding the Digital Services Tax

What the DST Entails

Canada’s digital services tax imposes a 3% levy on revenue generated by large technology firms—from online advertising and data services to digital marketplaces—provided by companies earning at least$750 million globally and$20 million in Canada. The tax is retroactive to January 2022 and could force U.S. tech giants such as Amazon, Google, and Meta to pay billions in back taxes. The measure is designed to capture revenue from companies that benefit from the Canadian market without maintaining a significant physical presence.

The Rationale Behind the Tax

Canadian authorities argue that the DST levels the playing field by ensuring that multinational digital companies contribute fairly to the local economy. A government spokesperson explained, “Digital giants benefit from Canadian infrastructure and user bases but do not pay their fair share of taxes. This measure is about fairness and financial responsibility.” With similar taxes already in place in parts of Europe, Canada sees the DST as a necessary step while waiting for a global consensus under the OECD framework for digital taxation.

Why U.S. Leaders Object

From the U.S. perspective, the tax is seen as a discriminatory measure aimed squarely at American tech companies. Trump and his supporters maintain that such a tax penalizes U.S. businesses and disrupts the fair terms of trade that have long underpinned U.S.-Canadian economic relations. Citing the DST as an example of unfair treatment, Trump declared the move a threat to U.S. economic interests and a hindrance to smooth bilateral trade.

Economic and Diplomatic Impacts

Effects on Key Industries

The U.S. and Canada share a trade relationship valued at over$900 billion every year, with billions of dollars in goods crossing the border daily. The imposition of tariffs in retaliation for Canada’s DST could disrupt several vital sectors:

-

Technology: U.S. tech firms, now facing potential retroactive payments upwards of$2.7 billion, might scale back investments in Canada. This slowdown could affect innovation and digital infrastructure on both sides of the border.

-

Automotive and Manufacturing: Cross-border supply chains are finely tuned, and any interruption may cause production delays and increased costs. The automotive sector, which depends on a seamless flow of parts and materials, could face significant challenges if tariffs are enacted.

-

Agriculture and Dairy: Canada’s dairy industry and other agricultural sectors that rely on the U.S. market may suffer losses. Tariffs could reduce market access for Canadian exports, impacting local producers and pricing structures.

-

Energy: As one of the largest suppliers of oil and natural gas to the U.S., Canada’s energy sector may encounter market volatility if trade barriers disrupt established channels.

Diplomatic Strains

Diplomacy between the U.S. and Canada has long balanced cooperation with occasional friction. The abrupt termination of trade talks, however, injects a new level of tension into the relationship. Analysts worry that this tough stance could lead to a cycle of retaliatory measures that extend beyond tariffs into broader economic and political arenas. The possibility of escalating tariffs not only threatens commercial interests but also risks undermining decades of cooperative engagement on other key issues like climate change, security, and regional stability.

Expert and Official Reactions

Reactions from U.S. Officials and Business Leaders

Former President Trump’s declaration on social media, stating the tax is a “direct and blatant attack on our country,” set an aggressive tone that resonates with his supporters. U.S. business leaders in the tech sector have voiced concerns about the financial burden and potential loss of investment stemming from the DST. One trade expert noted, “Escalating tariffs and strained trade talks could have ripple effects, destabilizing supply chains and negatively impacting consumer prices across North America.”

Canadian Perspectives and Counterarguments

Canadian officials, while cautious not to escalate the matter further, defend the DST as a necessary measure for ensuring that foreign companies contribute fairly to Canada’s economy. A spokesperson for Prime Minister Mark Carney remarked, “We believe that digital giants should pay taxes in the jurisdictions where they benefit. This tax is about maintaining fiscal fairness.” Some Canadian business leaders also argue that while the measure might invite short-term friction, it is an essential step to correct long-standing tax imbalances in the digital age.

Balancing the Debate

Trade experts emphasize that the dispute over the DST is part of a larger global debate on how to tax the digital economy. With countries like France, the United Kingdom, and India considering or implementing similar measures, the U.S. position may have broader implications. “This is not just about U.S. tech companies versus Canadian policy,” explained Dr. Lisa McGregor, a North American trade analyst. “It is about establishing fair tax practices in a digital era where traditional rules no longer apply.” The heated exchange also highlights the challenges of maintaining a balanced trade relationship when national interests come into conflict with evolving global economic realities.

A History of U.S.-Canada Trade Relations

The Economic Bond

The United States and Canada share one of the world’s most robust and integrated economic relationships. Over the years, myriad agreements, such as NAFTA and later the USMCA, have reduced barriers and integrated industries, from energy to automotive manufacturing. The two nations exchange goods and services worth hundreds of billions of dollars, making them indispensable trading partners. Daily, goods valued at approximately$2 billion cross the border, ensuring that trade disruptions have far-reaching economic consequences.

Past Trade Disputes

While the digital services tax dispute may seem unique, it echoes past conflicts that have periodically strained the relationship. Historical battles over softwood lumber and dairy quotas have long tested U.S.-Canada trade ties. Each dispute brought temporary tension but also led to negotiations that ultimately preserved the broader partnership. The current DST disagreement follows in this tradition, representing both the evolution of the modern economy and the persistence of deep-rooted trade challenges.

Learning from History

The historical context underlines the importance of finding balanced solutions. Previous trade disputes have been resolved by dialogue and compromise, which allowed for the evolution of mutually beneficial trade agreements. As the global economy shifts toward a more digital focus, both nations may need to adapt their strategies. Finding a common ground on digital taxation could help avoid further economic fallout and maintain the long-standing positive relationship between the United States and Canada.

What Lies Ahead for U.S.-Canada Trade

The immediate future of U.S.-Canada trade remains uncertain. With Trump’s warning of imminent tariffs and Canada’s firm stance on its DST, both sides face difficult choices. The potential escalation could lead to a series of retaliatory measures that might disrupt supply chains, hurt consumers, and affect millions of livelihoods.

Policy analysts urge dialogue and compromise. Reengaging in trade talks could allow leaders to address not only the DST but also to revisit other unresolved issues that have historically marred the relationship. Stakeholders from both sides are calling for discussions that balance the need for fair digital taxation with the preservation of a critical economic partnership.

Looking ahead, the situation raises important questions about the broader framework for international digital taxation. As more countries consider similar taxes, a global consensus may be necessary to prevent further trade imbalances. Both the United States and Canada might ultimately benefit from working towards a comprehensive multilateral agreement that fosters fair competition in the digital economy while protecting the interests of local markets.

Your Voice Matters

This unfolding trade dispute touches on the future of digital business, tax fairness, and even everyday consumer prices. It invites us to consider how global digital giants should operate in local markets and what steps are needed to maintain one of North America’s most critical trade relationships. What do you think? Should digital companies be required to pay more taxes in the countries where they operate? How might tariffs and trade talk breakdowns affect your community or industry?

Leave a comment below and share this article with your friends to help spark dialogue on how best to balance national interests and global trade in a rapidly changing digital era.

Identifying G20 Countries with Digital Services Taxes

First, we need to identify which G20 countries have implemented a Digital Services Tax (DST). DSTs are taxes levied on revenue generated from digital services, often targeting large multinational technology companies.

As of June 28, 2025, the following G20 countries have implemented or are in the process of implementing a DST:

France: France was one of the first countries to implement a DST, targeting companies with significant digital revenues generated within the country.[1]

Italy: Italy has also implemented a DST, similar to France’s, focusing on digital services revenue.[2]

Turkey: Turkey has introduced a DST, expanding the scope of taxation to digital services.[3]

India: India has implemented equalization levies, which function similarly to a DST, targeting digital transactions.[4]

Argentina: Argentina has implemented a digital tax on digital services.[5]

South Korea: South Korea has implemented a digital tax on digital services.[6]

United Kingdom: The UK has implemented a Digital Services Tax.[7]

Spain: Spain has implemented a Digital Services Tax.[8]

Indonesia: Indonesia has implemented a digital tax on digital services.[9]

Implications for Social Media Giants

Other G20 countries have considered or are considering DSTs, but haven’t yet implemented them as of the current date. These include countries like Brazil and Canada, which have been actively discussing the implementation of DSTs.

The implementation of DSTs has significant implications for social media giants, particularly those not domiciled in the countries imposing the tax. These implications include:

Increased Tax Burden: Social media companies with significant revenue generated in countries with DSTs will face a higher tax burden. This can impact their profitability and potentially lead to adjustments in their business strategies.

Compliance Costs: Complying with DST regulations requires significant resources. Social media giants must track revenue generated in each country, calculate the tax liability, and file tax returns, leading to increased administrative and compliance costs.

Potential for Double Taxation: The implementation of DSTs can lead to double taxation if the company is also subject to corporate income tax in its home country. This is a major concern for multinational companies and is a key reason why many countries are working towards a multilateral solution through the OECD.

Impact on Pricing and Services: To offset the increased tax burden, social media companies might consider increasing prices for their services or reducing investments in the affected countries. This could impact users and the overall digital ecosystem.

International Tax Disputes: DSTs have led to international tax disputes, particularly between countries imposing the tax and the home countries of the social media giants. These disputes can create uncertainty and instability in the international tax landscape.

OECD’s Role: The Organization for Economic Co-operation and Development (OECD) is working on a multilateral solution to address the tax challenges arising from the digitalization of the economy. This includes a framework for taxing multinational enterprises, which could potentially replace or modify existing DSTs. The progress of this framework will significantly impact the future of DSTs and the tax burden on social media giants.

Therefore, as of June 28, 2025, at least nine G20 countries have implemented a Digital Services Tax (DST) or similar measures. These taxes increase the tax burden and compliance costs for social media giants, potentially leading to price adjustments, international tax disputes, and the need to navigate a complex and evolving international tax landscape.

Authoritative Sources

France’s Digital Services Tax. [French Government Website]↩

Italy’s Digital Services Tax. [Italian Revenue Agency]↩

Turkey’s Digital Services Tax. [Turkish Revenue Administration]↩

India’s Equalization Levy. [Indian Income Tax Department]↩

Argentina’s Digital Services Tax. [Argentine Tax Authority]↩

South Korea’s Digital Services Tax. [South Korean Tax Authority]↩

UK’s Digital Services Tax. [UK Government Website]↩

Spain’s Digital Services Tax. [Spanish Tax Agency]↩

Indonesia’s Digital Services Tax. [Indonesian Tax Authority]↩