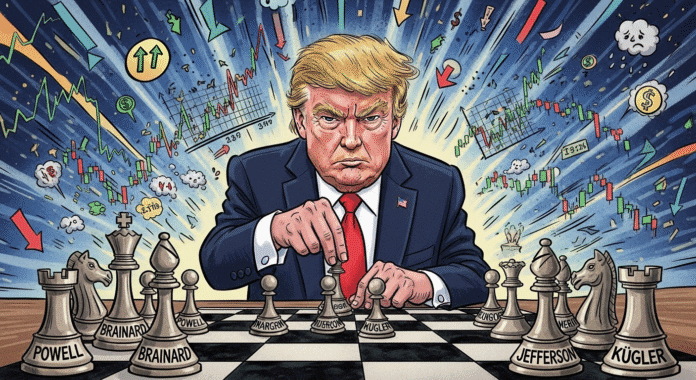

Trump Attacks Fed Independence Through Lisa Cook Firing

Trump’s Power Grab Threatens Fed’s Historic Independence

President Donald Trump’s administration doubled down Sunday on its unprecedented attempt to fire Federal Reserve Governor Lisa Cook, marking the first time in the central bank’s 112-year history that a president has tried to remove a sitting governor. This dramatic power play comes just days before the Fed’s crucial interest rate decision, raising serious questions about political interference in monetary policy.

The Trump administration renewed its request to the U.S. Court of Appeals for the District of Columbia, arguing that Cook should be removed “for cause” ahead of this week’s Federal Open Market Committee meeting. The timing isn’t coincidental—Trump has relentlessly pressured the Fed to slash interest rates, and Cook’s removal could tip the balance in favor of more aggressive rate cuts.

The Shaky Foundation of Fraud Allegations

The accusations against Cook center on mortgage documents from 2021, before she joined the Fed. Bill Pulte, Trump’s appointee to the Federal Housing Finance Agency, accused Cook of claiming two properties—one in Atlanta and another in Ann Arbor, Michigan—as “primary residences” to secure better loan terms.

However, newly surfaced documents appear to refute these claims. A loan estimate from Cook’s credit union clearly identifies her Atlanta property as a “vacation home,” directly contradicting Pulte’s allegations. The Associated Press obtained documents showing Cook described the property as a “second home” on security clearance forms.

“The government continues to ignore the facts that have been publicly reported on and cited in our briefs that refute their allegations against Governor Cook,” said Abbe Lowell, Cook’s attorney, in response to the administration’s latest filing.

A Historic Attack on Fed Independence

Cook’s legal team warns that allowing her removal would set a dangerous precedent. In Saturday court filings, her lawyers argued that Trump’s action threatens the foundation of central bank independence.

“A stay by this court would therefore be the first signal from the courts that our system of government is no longer able to guarantee the independence of the Federal Reserve,” Cook’s attorneys wrote. “Nothing would then stop the president from firing other members of the board on similarly flimsy pretexts. The era of Fed independence would be over.”

This warning carries weight beyond political rhetoric. Central bank independence has been a cornerstone of American economic policy for decades, helping maintain investor confidence and market stability.

The Real Stakes: Interest Rates and Economic Control

The Federal Open Market Committee meets Tuesday and Wednesday to decide on interest rates. Most economists expect a quarter-point rate cut, but Trump has pushed for more aggressive cuts to stimulate economic growth.

Cook, the first Black woman to serve as a Fed governor, represents a voice of caution on the seven-member Board of Governors. Her removal would allow Trump to appoint a replacement likely to favor steeper rate cuts, potentially reshaping monetary policy to align with his political agenda.

The Fed has maintained higher rates to combat inflation concerns, particularly given uncertainty around Trump’s tariff policies. Chair Jerome Powell, whom Trump has nicknamed “Mr. Too Late,” has resisted political pressure to dramatically lower rates.

Legal Battle Intensifies

U.S. District Judge Jia Cobb ruled Tuesday that Trump’s attempted firing was illegal and reinstated Cook to the board. The judge determined that alleged mortgage discrepancies from before Cook’s Fed tenure don’t constitute proper “cause” for removal under federal law.

Trump’s legal team argues the president has broad discretion to determine what constitutes “cause” for removing Fed governors. They contend that Cook’s alleged conduct, even if it occurred before her appointment, “calls into question Cook’s trustworthiness and whether she can be a responsible steward of the interest rates and economy.”

The Broader Pattern of Presidential Overreach

This controversy fits a troubling pattern of Trump attempting to bend independent institutions to his will. Beyond targeting the Fed, his administration has sought to reshape other regulatory agencies and remove officials who don’t align with his agenda.

Senator Elizabeth Warren warned in August that “Trump’s attempting to fire Lisa Cook to turn the Federal Reserve into the ‘Central Bank of Trump.'” Her concerns about undermining “the world’s confidence in our economy” reflect genuine worries among economists and market watchers.

What Happens Next

The appeals court is expected to rule Monday on Trump’s emergency request to stay the lower court’s injunction. If unsuccessful, the administration may ask the Supreme Court to intervene—setting up a constitutional showdown over presidential power versus institutional independence.

Cook’s attorney characterized the effort as a “smear campaign” designed to help Trump seize control of the Fed. Meanwhile, the administration doubles down on claims that Cook’s trustworthiness remains in question.

The outcome could reshape the relationship between the White House and the Federal Reserve for years to come. More immediately, it threatens to inject political chaos into this week’s crucial interest rate decision.

Defending Democratic Institutions

The Lisa Cook controversy represents more than a personnel dispute—it’s a test of whether democratic institutions can maintain independence from political interference. The Federal Reserve’s ability to make decisions based on economic data rather than political pressure has helped stabilize the American economy through multiple crises.

Citizens must recognize that attacks on institutional independence, even when cloaked in allegations of misconduct, threaten the foundations of good governance. Whether Cook committed any impropriety matters less than the dangerous precedent of presidential interference in Fed operations.

Americans deserve a Federal Reserve that operates free from political pressure, making decisions based on economic evidence rather than electoral calculations. The fight over Lisa Cook’s position will determine whether that independence survives the current administration’s power grab.

Call to Action: Contact your representatives and demand they protect Federal Reserve independence from political interference. The stability of our economic system depends on preserving institutional boundaries that have served America well for over a century.