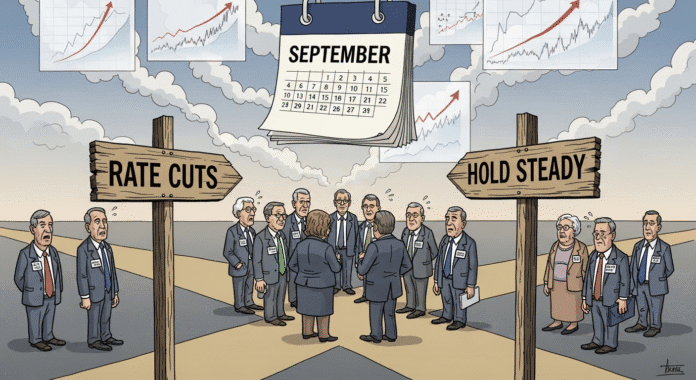

Stubborn Price Pressures Challenge Central Bank’s Easing Plans

The Federal Reserve’s hopes for clear sailing toward interest rate cuts just hit another speed bump. Core inflation climbed to 2.9% in July, marking the 53rd consecutive month above the central bank’s 2% target and throwing fresh uncertainty into September’s policy meeting.

The Bureau of Economic Analysis delivered the expected yet unwelcome news Friday morning. Core personal consumption expenditures (PCE) inflation rose 0.1 percentage point from June’s 2.8%, exactly matching analyst forecasts but reinforcing concerns about persistent price pressures in the world’s largest economy.

This reading carries extra weight. It’s the final major inflation report before Fed officials gather for their September 17-18 meeting, where markets had been pricing in strong odds of the first rate cut since the pandemic-era easing cycle ended.

Why This Number Matters More Than Others

The core PCE index strips out volatile food and energy prices, giving Fed officials their preferred window into underlying inflation trends. Unlike the more familiar Consumer Price Index, PCE captures how consumers actually adjust their spending when prices change.

“The core PCE has become the Fed’s north star for monetary policy,” explains the data’s significance. When this measure stays elevated, it signals that price pressures have spread beyond just gas pumps and grocery stores into the broader economy.

July’s 2.9% reading, while modest on its face, represents a troubling pattern. The Fed launched its most aggressive rate-hiking campaign in four decades specifically to bring this number down to 2%. Yet here we are, 53 months later, still missing that target.

Fed Officials Face Growing Pressure

The timing couldn’t be more challenging for Fed Chair Jerome Powell and his colleagues. Earlier this year, Powell warned that tariffs could push prices higher, adding another wild card to an already complex inflation equation.

Market pressure for rate cuts has intensified recently, with investors betting heavily on easing measures. CME’s FedWatch tool showed significant probabilities for quarter-point cuts before Friday’s data release.

Some Fed officials have already shown their hand. Governors Michelle Bowman and Christopher Waller dissented at June’s meeting, arguing for immediate rate reductions despite ongoing inflation concerns. Their position gains complexity with each stubborn inflation reading.

Adding political pressure to the mix, former President Donald Trump has publicly pressed for rate cuts, though Fed independence typically shields monetary policy from such influence.

What the Broader Picture Shows

While core PCE disappointed, headline personal consumption expenditures told a slightly better story at 2.6%. This broader measure includes the food and energy costs that directly hit consumer wallets.

The gap between headline and core inflation suggests that while gas and grocery prices have moderated somewhat, underlying service costs and housing expenses continue climbing. This pattern makes Fed officials particularly nervous because service inflation tends to be more persistent than goods price spikes.

July’s data also reveals how economic crosscurrents complicate simple narratives. Job markets remain relatively strong, consumer spending continues, yet price pressures persist across key sectors.

September Meeting Stakes Rise

Fed officials now face a delicate balancing act heading into their September gathering. Market expectations for rate cuts haven’t disappeared entirely, but July’s inflation reading provides ammunition for hawks who want to keep policy tight.

The central bank’s dual mandate requires attention to both employment and price stability. With unemployment still near historic lows but inflation above target for more than four years, officials must weigh competing risks carefully.

Economic data between now and September 17 will prove crucial. Employment reports, retail sales figures, and any additional inflation readings could tip the scales toward action or continued patience.

Looking Beyond September

The 53-month streak above 2% inflation target represents more than just stubborn numbers. It suggests structural changes in how prices behave in the post-pandemic economy might require new approaches to monetary policy.

Supply chain disruptions, labor market shifts, and changing consumer behavior have all contributed to this inflation persistence. Simply raising interest rates – the Fed’s primary tool – may not address all these underlying factors.

Recent warnings about tariff impacts add another layer of complexity. Trade policy decisions can directly affect price levels, potentially undermining monetary policy effectiveness regardless of interest rate levels.

The Path Forward

July’s core inflation reading doesn’t doom rate cut prospects entirely, but it certainly complicates the Fed’s decision-making process. Officials must now weigh whether 2.9% represents acceptable progress toward their 2% target or evidence that more restrictive policy is needed.

Market participants will scrutinize every Fed official’s public comments between now and September’s meeting. Any hints about policy direction could trigger significant moves across bond and equity markets.

The broader economic implications extend beyond monetary policy. Persistent inflation affects real wages, consumer spending power, and business investment decisions. Getting this balance right matters for millions of American workers and businesses.

What This Means for You

For ordinary Americans, July’s inflation reading signals that relief from price pressures may take longer than hoped. While 2.9% isn’t catastrophic, it means the Fed will likely maintain its cautious approach to rate cuts.

This translates to continued high borrowing costs for mortgages, credit cards, and business loans. Anyone hoping for immediate relief from elevated interest rates should prepare for potential delays.

However, the Fed’s careful approach also aims to prevent inflation from accelerating again. The central bank learned painful lessons from the 1970s about prematurely declaring victory over price pressures.

Stay informed about economic developments, as the next few weeks will provide crucial insights into the Fed’s likely September decision. The stakes for both monetary policy and the broader economy have rarely been higher.